Low water levels increasingly affect cost of goods

The lack of water at critical stages in plant production is a perennial concern for farmers, but farmers and consequently consumers around the world are increasingly facing post-harvest worries as low river water levels increase the cost of shipping corn, soybeans, and other goods. According to the USDA, barges move 50 to 60% of U.S. grains destined for export. Last year and again this year, lower water levels along the Mississippi River have reduced the use of barges by as much as 25%. Reduced river flows mean narrower travel channels, smaller tow sizes (the number of barges lashed together), reduced loading drafts, and increased transit times. In short, water woes increase the volume of crops traveling by truck or train and increase shipping costs. In turn, increased shipping costs affect the prices producers receive and the prices domestic and international consumers pay.

Similarly, farmers in Brazil, who recently became the world’s number one exporter of corn, may lose that status as their corn exports from Amazonian ports have fallen with the river levels. Amazon River ports, which account for 30% of the Brazilian exports, are facing the effects of a typical dry season made worse by an El Niño weather pattern in the Southern Hemisphere. As a recent USDA ERS article highlights, while Brazil’s importance in world markets is growing, they are increasingly facing new challenges, including low river levels. As Brazil diverts harvests to its southern ports by truck and rail, the cost of shipping increases by 20% or more which increases transportation delays. Just as in the U.S., increased transportation costs affect returns to farmers and the prices consumers pay.

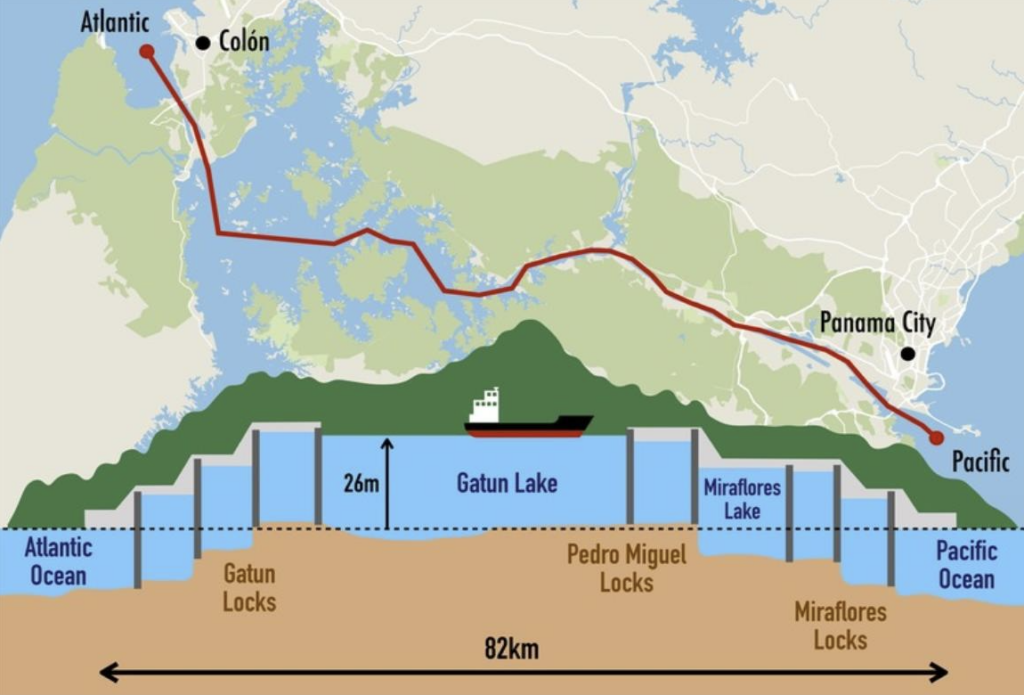

Water levels affect canal crossings

As if the lack of water in major river systems did not make exporting grains difficult enough, the lack of rain has also created an increasingly serious constraint at the Panama Canal. Panama Canal Authority restricted ship crossings, which rely on fresh water from rain-fed Lake Gatun to operate the locks, to twenty-five crossings in November. This winter, the Authority could reduce the number of crossings to eighteen (compared to about forty transits per day under normal conditions). In the near-term, higher valued energy and container ships are vying for most of the transit slots (transit fees have quadrupled from $900,000 to almost $4 million) and congestion on both sides of the canal has increased. For U.S. farmers this means shipping grains destined for Asia by rail to the west coast. As fewer ships transit through the canal, this puts upward pressure on inflation as transportation costs increase. The recent decline in shipments between Asia and the U.S. may have a moderating influence on prices, but the impact of that shift has yet to measured.

The negative impact of fewer Panama Canal crossings extends beyond rising transport costs for U.S. and Brazilian grain and soybean exports. Even the cost of transiting the Suez Canal has been affected, in part, as Asian shippers seeking to service east coast U.S. and European ports have re-routed through the Suez Canal. As result, the Suez Canal Authority has adjusted to increased transit demands by increasing transit fees about five percent for North American and European bound ships. Sadly, recent Red Sea security events have undermined the viability of that route too.

What happens now?

Increased moisture in the form of snow and rain will help water levels along the Mississippi, even if winter weather slows water flows into the river. For Brazil and the Panama Canal, however, the El Niño climate pattern is associated with warmer-than-usual water temperatures in the central and eastern tropical Pacific Ocean, which are not as seasonal. The U.N.’s Food and Agriculture Organization projects that global grain production this year will be up slightly which should partially offset the impact of global food and feed transportation disruptions. Nonetheless, these events are reminders of just how interconnected supply chains and economic prospects are and, as a result, how the impacts of natural events can cascade across sectors and around the globe.